|

PLUS: Discover the little-known hedge fund

investing strategy that’s helped investors

pick up gains of 222%… 276%…

even 452%… over the past two years!

Dear Fellow Investor,

I’m Charles Sizemore and today I want to share with you the single best way I know of to make huge profits in a hurry. There’s simply no better way than investing in what I call “baby boomer stocks.” I’m Charles Sizemore and today I want to share with you the single best way I know of to make huge profits in a hurry. There’s simply no better way than investing in what I call “baby boomer stocks.”

By “baby boomer stocks” I mean companies that are taking advantage of a rock-solid, unchangeable demographic fact: the largest, richest generation in U.S. history is retiring at the rate of10,000 people per day… and will continue retiring at this rate until about2024.

As a group, the 80 million baby boomers account for75% of all drug spending (no surprise there!), and spend 40% more on travel than other demographic groups.

Savvy trend investors (including baby boomers themselves!) are already cashing in big time on this major demographic play.

For example, Amgen (AMGN), with its monoclonal antibody drug Denosumab for the treatment of osteoporosis, has seen its stock jump 58.2% in the past 12 months alone, from $67 to $106 a share.

Royal Caribbean Cruises (RCL), another classic boomer stock play, is also doing well. Its stock shot up from just $5.93 a share in early 2009 to $37 a share today.

That’s a 523.9% total return—or an average annual gain of 58%.

So I ask you: How many other sectors do you know of that hand you 58% a year profits consistently? How many other sectors let you turn $100,000 into$623,900 in just four years? So I ask you: How many other sectors do you know of that hand you 58% a year profits consistently? How many other sectors let you turn $100,000 into$623,900 in just four years?

Then there’s Express Scripts (ESRX), a company whose self-proclaimed mission is to make it more affordable and safer touse prescription drugs.

Express Scripts specializes in helping medical consumers cut costs through such services as pharmacy home delivery and discount drug card programs.

Over the past four years, its stock has skyrocketed from just $22 a share to $61.56—a gain of 179.8%.

Bottom line:

Name a Baby Boomer Obsession,

Vice or Need… and I’ll Show You How Trend

Investors Are Making a Small Fortune Off of It

Take wrinkles! You think youth-obsessed boomers like wrinkles?

No other group in history has spent more hard-earned cash trying to turn back the clock on aging than baby boomers.

It’s no surprise,then, that companies that manufacturer anti-wrinkle creams—such as Revlon(REV) with its Revlon Age Defying Moisturizing Concealer—are making money faster than they can count it. It’s no surprise,then, that companies that manufacturer anti-wrinkle creams—such as Revlon(REV) with its Revlon Age Defying Moisturizing Concealer—are making money faster than they can count it.

Revlon stock has gained an eye-popping 567.2%since 2009.

Finally, there’s sex and romance!

Baby boomers think they invented sex, so you might expect that companies that cater to baby boomers in the romance department might do well—and you’d be right!

In 2011, the dating company InterActiveCorp (IACI), which runs Match.com, launched OurTime.com, a site dedicated to the 50-plus crowd. Its stock has gained 240.1% over the past four years—or a compound annual growth rate of 35.81%.

I’m telling you: Investing in aging baby boomers’needs and desires is a great way to make solid profits.

That’s because “demography is destiny,” as the saying goes—and it’s hard not to make money when 80 million people are all buying the same products and need the same services.

Well, the companies I’ve just mentioned are all great ways to invest in the demographic trend that is baby boomer retirement.

But there is one way that I believe might top even these…

How to Double Your Money by Helping Baby

Boomers Stay the Heck Out of Nursing Homes!

If you think baby boomers don’t like wrinkles and do like cruises, you can imagine what they think of that great American signpost to old age: the nursing home.

It’s something most want to avoid at all costs!

As a result, one investment I currently recommend is actually an alternative to nursing homes—a company that provides home health care services for people who want to stay out of nursing homes. As a result, one investment I currently recommend is actually an alternative to nursing homes—a company that provides home health care services for people who want to stay out of nursing homes.

The company is a leading provider of home health nursing, rehabilitation and personal care services, with over 100 locations in 11 states.

And guess what? Business is good—very, very good.

If you had invested in this company a decade ago, you could have turned every $10,000 into $100,000.

That’s right: It’s multiplied investors’ money by 10 times… and it’s only getting started.

That’s because the majority of Baby Boomers are still in their early- to mid-50s and have years to go before retirement!

You can buy shares of this home health care services company for around $20… and I think it could easily top $50 a share within 12 to 24 months.

As the number of elderly patients stretches Medicare budgets to the limit, the government will be looking for ways to cut costs.And using this company’s services helps them to do exactly that—while also improving the lives of aging baby boomers.

If there is any trend more certain than demographics,it would be the government looking to cut corners. And in the age of government sequesters and trillion dollar budget deficits, this has never been more true.

I tell you all about this ultimate babyboomer stock play in a brand-new special report I’ve just prepared. I tell you all about this ultimate babyboomer stock play in a brand-new special report I’ve just prepared.

It’s called The Top 5 Million-Dollar Trends of 2013-2015.

This valuable special report tells you all about the baby boomer retirement trend—and four other major economic and demographic shifts that I believe can make you a small fortune over the next couple of years.

I’ll tell you all about how you can receive your FREE copy in a moment of The Top 5 Million-Dollar Trends of2013-2015.

But first, let me explain briefly why I believe investing in demographic trends is perhaps the most profitable investing strategy there is for the average investor…

Why Demographic Trend

Investing is a Path to Real Wealth!

As I mentioned, my name is Charles Sizemore.

I’m the founder of Sizemore Capital Management and a regular investment analyst seen on CNBC, Bloomberg and Fox Business.

After I finished my master’s degree at the London School of Economics, I decided to work with Harry S. Dent, Jr., author of the bestsellers The Great Boom Ahead and The Roaring 2000s (1998).

Harry is famous for accurately predicting, in the early 1990s, when doom and gloom forecasts were the norm in the financial press, that the Dow would cross 10,000 due to the spending patterns of the baby boom generation—a prediction that came true with amazing accuracy.

At the same time, he also correctly forecast that the Japanese bubble economy would burst. And we all know how that turned out!

Harry and I tend to apply demographic analysis to different areas of the capital markets, but the basic insight we both accept is that understanding demographic trends can unleash enormous profit opportunities… IF you know how to take advantage of them.

For example, investing in global trends let me nearly DOUBLE my money last year on a single investment (93.5% gains) by cashing in on the financial services boom…

… and pocket gains of 77% and 69% cashing in on one of the biggest macro trends of the past century.

It’s the same strategy that you could have used to more than double your money in the first three months of 2013—simply by investing in one easy-to-buy ETF.

It’s also why I was able to WIN the 2011 Best Stocks contest and placed second in a VERY tight race in 2012—beating out some of the most famous stock pickers and analysts in the world.

I’m not telling you all this to brag.

I’m telling you this because you absolutely can do this, too.

The Macro Trend Investing StrategyThat

Can Potentially Grow Every $100,000 Portfolio

into $1.3 Million in Just 10 Years!

In fact, if you had been following one particular trend investing strategy over the past 10 years, you could have potentially turned every $100,000 portfolio into $1,378,584…

… even with the 2008-2009 stock market crash.

Investing in Global Macro Trends is one of the reasons why investors at Continental Partners have pocketed a total return,over the past three years, of 3,204.3%.

That’s enough to turn every $5,000 invested into$160,000.

And it’s also how hedge fund investor Ed Seykota was able to turn a $50,000 account into $300 million… and George Soros was able to turn every $100,000 initially invested in his Quantum Fund into $420million.

Investing in global trends is how the guys over at Stewart Capital have averaged an annual return of 75.27% since 2002.

If you had parked $50,000 in an S&P 500 index fund that year, today you’d have $76,000, including reinvested dividends.

That’s a total return of 52% or an average annualreturn of 3.98%.

However, if you had taken the same $50,000 and givenit to Stewart Capital when they started in March 2002, today you’d have…

$21 million!

Stewart Capital’s total compounded return since inception is… 43,572.86%.

That’s 435 times your investment. In about 12 years. That’s 435 times your investment. In about 12 years.

Now over the past several months, I’ve been compiling a detailed dossier of the major demographic and economic trends developing worldwide—along with the specific, highly targeted investments that will profit from them.

These macro trends and the investments tied to them have the potential to make you staggering, life-changing profits—and at the end of this message, I’ll tell you how to get a copy of my new special dossier, TheTop 5 Million-Dollar Trends of 2013-2015, that shows you how.

But before I tell you how to get your free copy, letme give you a brief preview of another major trend I believe can make you asizeable amount of money…

Million Dollar Global Trend #2:

Cashing in on the U.S. Domestic

Energy Revolution

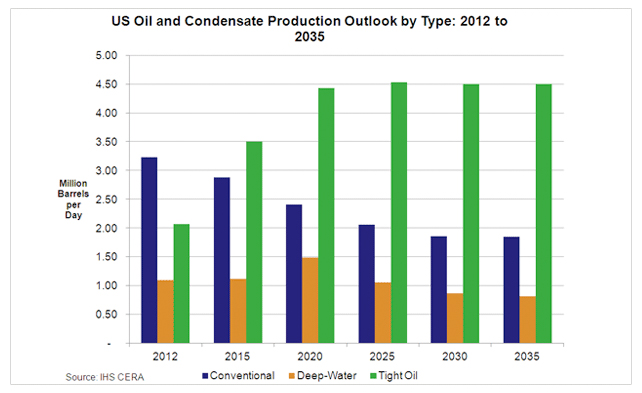

The second global trend topping my list is the U.S.domestic energy revolution.

So-called “fracking”—the extraction of oil embedded in tiny pockets of rock—as well as the discovery of new sources of natural gas—means that the U.S. will soon be a net exporter of energy.

Let me tell you: This really is a game changer… and it’s going to make a lot of investors very, very rich and very, very quickly.

In fact, it’s already doing so.

According to a new report from the U.S. Geological Survey, the U.S. has an estimated 198 billion barrels of “technically recoverable” oil in the ground.

Other estimates, such as those of the Institute for Energy Research, put the total amount of technically recoverable oil much higher, around 1.4 trillion barrels.

Either way, when combined with other energy sources,including vast new natural gas deposits, we clearly have enough energy sources to meet our needs for the foreseeable future.

Make no mistake: this is HUGE.

Here’s one way to see it. In 2011, the trade deficit was $577 billion. The dollar value of imported oil was $439 billion.

So, for all of the wailing and gnashing of teeth about Chinese imports “hollowing out” American industry, the real elephant in the room is energy.

Energy imports accounted for more than 75% of the trade deficit.

Against this backdrop, the shale gas/fracking boom is a God-send.

Abundant, cheap energy means at least a partial solution to the imbalances that have plagued the United States for the past two decades.

Now, here's the amazing part of the story…

The missing piece of the puzzle to make the U.S. energy independent is not the resources themselves but the infrastructure (pipelines, refineries) that can put them to use. The missing piece of the puzzle to make the U.S. energy independent is not the resources themselves but the infrastructure (pipelines, refineries) that can put them to use.

This is one global macro trend that can make you seriously rich—and has already made savvy investors large piles of money.

One energy infrastructure investment I recommend has skyrocketed 222% since mid-2010.

Another is up 276% in the same time period.

A third is up 452%.

These are conservative, rock-solid dividend payers that also happen to sit in the middle of one of the biggest macro trends of the next decade.

I’ll tell you all about these investments… and four more just like it… in your copy of The Top 5 Million-Dollar Trends of 2013-2015.

But before I tell you how to get your copy, let me tell you about another global macro trend that has me just as excited…

Million Dollar Global Trend #3:

Getting Rich with the

Next Baby Boom of Generation Y!

Generation Y, people who are in their 20s and very early 30s today, are known as “echo boomers” because, you guessed it, they are the children of the Baby Boomers.

The largest generation in history produced a generation of children nearly as big!

In fact, EchoBoomer women are the biggest pool of potential mothers since the original Baby Boom! In fact, EchoBoomer women are the biggest pool of potential mothers since the original Baby Boom!

They are having fewer children per woman today due to the state of the economy. But due to the sheer size of their generation, they’ve managed to keep America’s delivery rooms bursting full of babies.

Bad economy or not, people do not postpone parenthood forever. Biological clocks keep on ticking.

And as the Echo Boomers finally leave the nest and start their adult lives, we will see the biggest baby boom since the1950s.

This means a bull market in everything from starter homes to diapers.

And here’s one way we can profit right away from this demographic bonanza: baby formula!

Many young women prefer to nurse, but most families use formula at least to supplement, and many working women lack any other option.

One investment I really like makes one of the best-selling baby formulas.

If you want to know how powerful Global Macro Trends really are, consider this: This little baby formula company has $4 billion in annual sales and makes a gross profit of $2 billion!

If you had purchased shares just four years ago, you would have already nearly TRIPLED your money…

That works out to an average return of 30.4% a year.

That’s how you build serious wealth.

A consistent return of 30% a year would let you turn a $100,000 portfolio into $1,378,584 in just 10 years.

Can you see why I say macro trend investing is “the”way to build wealth in the coming years?

I explain all this in detail… and tell you all about the baby formula company… in The Top 5 Million-Dollar Trends of 2013-2015.

Million Dollar Global Trend #4:

The Rise of the Emerging Market Consumer

and the New Global Middle Class

One more trend: The rise of the emerging market consumer and the new global middle class.

This is one that’s easy to understand.

If you want to know what this global macro trend is all about, all you have to do is stroll down Nanjing Road, Shanghai’s main shopping street, on a Saturday afternoon.

Along the car-free pedestrian boulevard that extends east toward People’s Square you’ll see the luxury TAG Heuer watch makers shop… Jiuguang Department Store… Burberry’s largest store in Asia… Tiffany’s first branch in Shanghai… Dunhill’s first branch in Asia… and storefronts for many other well-known brands. Along the car-free pedestrian boulevard that extends east toward People’s Square you’ll see the luxury TAG Heuer watch makers shop… Jiuguang Department Store… Burberry’s largest store in Asia… Tiffany’s first branch in Shanghai… Dunhill’s first branch in Asia… and storefronts for many other well-known brands.

Put simply: The world’s teeming masses yearning to be free are now shopping!

20 years ago, China’s primary means of transportation was the bicycle. Today, it sells more cars than Detroit, and China is the#1 market for several luxury models.

From Bombay to Baghdad, Bucharest to Beirut, an estimated 2 billion members of the emerging markets middle class are spending money like there is no tomorrow.

While U.S. wages have been steadily declining for more than 20 years, the wages of the rest of the world’s global middle classes have been skyrocketing.

The consulting firm of McKinsey & Company estimates that their spending will increase from $6.9 trillion today to about $20 trillion in 10 years.

This represents a staggering opportunity for U.S.investors.

Investing in the right companies that serve the emerging markets middle classes is like buying Apple Computer in 1985.

For example, one investment I am currently recommending takes advantage of the skyrocketing growth in cell phone usage in China.

As you might expect, this company’s growth is almost off the charts.

It has annual revenues of $89 billion and a gross profit of $79 billion… and its stock is already up 24% since I recommended it.

There is A LOT more room for appreciation with this company… and with all the other investments I recommend for profiting from the emerging markets middle class trend.

I give you all the details in TheTop 5 Million-Dollar Trends of 2013-2015.

I’m running out of time, but I have to mention just one more macro trend that can make you a million dollars over the next 10years—precisely because it’s so contrarian.

Million Dollar Global Trend #5:

The Re-emergence of Europe as a

Global Economic Powerhouse

That’s the re-emergence of Europe as a global economic powerhouse.

That’s right: I said Europe.

Most American investors now think of Europe as a lost cause. Most American investors now think of Europe as a lost cause.

It seems to be breaking up before our very eyes.

Every week, it seems, there is a new disaster in the Eurozone making the markets skittish.

There seems to be a widening gulf forming between the austerity-minded countries of northern Europe, led by Germany, and the crisis-wracked countries of southern Europe.

But appearances can be deceiving… and Europe actually represents an enormous profit opportunity right now.

Here’s why…

For one thing, the world’s biggest economy is NOT the USA… or China… but Europe.

In fact, the 500 million citizens of the 27-nation EU have an economy that is more than twice as big as that of China.

It’s true that Europe’s economic recovery has been even worse than that of the U.S., with an unemployment rate still in the double digits.

But by several measures, Europeans are weathering the storm better.

According to UNICEF, the U.S. now has the second highest child poverty rate of all the developed nations of the world… with a staggering 23.1% of American children now living in poverty. Only Romania’s rate (25.5%) is higher.

In comparison, only 8.5% of children in France or Germany live in poverty.

What’s more, those who see the Eurozone breaking apart have no understanding of Europe or Europeans.

While the headlines offer scary stories about bank account seizures in Cyprus and Eurozone splitting “contagion” spreading through Europe, the continent is quietly becoming more integrated than ever.

Banking union is in its early stages, and continent-wide deposit insurance is not far behind.

The EU has had free movement of goods for years, but there is now a renewed push for continent-wide integration of services as well as a way to spur growth and investment.

Frankly, Europe doesn't have a choice. To borrow aline from Ben Franklin, they either hang together or they hang separately.

So how do we profit from the increased integration of Europe?

One way is to pick up shares of European companies that are now selling for pennies on the dollar.

One I particularly like is a battered Spanish telecom. Before the 2009 financial crisis, its stock was selling for $33 a share on U.S. stock exchanges. Today you can pick up shares for $13.

But this company has operations spread across the entire European continent, with major operations in the United Kingdom,Ireland, Germany, and the Czech Republic and Slovakia. As barriers continue to fall, its reach will only expand.

I think this Spanish company will easily double in value in the next few years… and it represents a slam-dunk opportunity to lock in sizeable profits even beyond that.

Introducing the Sizemore Investment

Letter for Macro Trend Investors…

Now, before I tell you how to get a FREE copy of The Top 5 Million-Dollar Trends of 2013-2015,let me tell you the reason why I'm reaching out to you today. Now, before I tell you how to get a FREE copy of The Top 5 Million-Dollar Trends of 2013-2015,let me tell you the reason why I'm reaching out to you today.

For years, I’ve limited access to my global trend recommendations to the private clients of my money management company.

There’s a good reason for that:

As a certified professional money manager, I cannot legally give you personalized advice without violating strict SEC regulations.

But in recent months, I’ve been getting a lot of pressure from investors to let more people receive my investment recommendations.

I’ve been doing a lot of television interviews lately and so I get a lot of requests for help.

As a result, I’ve decided to create an entry-level advisory service for small investors that takes advantage of the same methods, strategies, and techniques that I use for my private money management clients—but geared for the ordinary investor.

Introducing The Sizemore

Investment Letter…

You see, as a newsletter editor, I am legally allowed to give you general investment advice and even specific investment recommendations.

That’s protected by the First Amendment.

I can even give you specific investment recommendations with buy and sell prices, how-to videos, even real-time trading alerts. That doesn’t violate any rules.

With this new macro trend advisory service, you can get the same high-level investment advice as if you were a client of my elite capital management company… but without the rather sizeable fees that we charge.

In this breakthrough new program, you'll get the best investment recommendations that I have to offer.

You and I will make the same investments side by side.

We'll invest in the five major trends I’ve told you about today in this message — including the new U.S. energy revolution… the retirement of the baby boom generation… and the Generation Y baby boom…

We'll also take advantage of the rise of the middle classes in emerging markets… and the re-emergence of Europe as a global economic powerhouse.

We'll profit from all of these Global Macro Trends—together.

One day you’ll wake up and realize you’re actually making money again—and that your financial future is no longer tied directly to the up and down movements of the overall market.

When you take advantage of Global Macro Trends, like those I have just explained, it’s virtually impossible not to make money.

For example, I’ll show you how to prepare for the inevitable hike in interest rates once quantitative easing comes to an end.

I’ll show you how to get ready to invest in one ETF I like that will make you three times the profits when the bottom falls out of the bond market.

Investing this way is how the rich got rich.

Don’t take my word for it.

Here are what a few famous investors and financial commentators say about macro trend investing in general and my advisory service in particular:

“There are newsletters and then there is The Sizemore Investment Letter. Charles Sizemore’s ability to spot trends well in advance of the pack is without equal. You must subscribe.”

–Michael Robertson, President of Robertson Wealth Management Ranked#3 Financial Advisor in America #1 in Texas by Registered Rep Magazine

“Charles Sizemore always gives me good food for thought. I look forward to his newsletter every month.”

–John Mauldin, New York Times best-selling author Editor of Thoughts from the Frontline

Here’s What You Get as a CharterSubscriber to

The Sizemore Investment Letter

So here's everything your Charter Membership in my new Sizemore Investment Letter includes…

The moment you join, the first thing you'll get is my brand-new free special report with all of my current macro trend recommendations—The Top 5 Million-Dollar Trends of 2013-2015.

This no-nonsense, plain-English guide reveals in more detail why these five Global Macro Trends offer realistic opportunities to multiply your wealth many times over.

No guarantees, but here are a few of the investments it covers in detail:

- A fantastic investment that will let you earn eye-popping profits on the Generation Y starter house boom…with a company that invested heavily in starter homes that it currently rents out to tenants.

- Two emerging market consumer investments that could potentially double, even triple your money.

- A toy company that is reaping skyrocketing profits from the massive wave of “echo boomer” births that crested in2007, which happened to be the highest birth year in U.S. history, and that is already up more than 75% since I recommended it.

- A Norwegian energy company that is the second-largest gas provider in Europe (after Gazprom) and that will allow European countries to meet the strict new carbon emissions limits mandated by the EU.

- A Swiss watch company that makes over 70% of the movements (core mechanisms) put in watches by other Swisswatch makers and which totally dominates the global luxury watch market(and which is already up 33% since I recommended it just a few month sago)…

That’s to name just a few.

Plus, you’ll also get…

![•]() In-Depth Analysis of Specific Stocks with your unique perspective informed by your work with some of the world’s leading trend and demographic experts. In-Depth Analysis of Specific Stocks with your unique perspective informed by your work with some of the world’s leading trend and demographic experts.

![•]() Model Macro Trend Portfolio specifically designed to take advantage of the most important Global MacroTrends… the same trends that many successful hedge fund and money managers have used to make enormous profits even in down or sideways markets. Model Macro Trend Portfolio specifically designed to take advantage of the most important Global MacroTrends… the same trends that many successful hedge fund and money managers have used to make enormous profits even in down or sideways markets.

![•]() Trading Flash Alerts anytime there is a hot opportunity or it’s time to sell. I will get follow-up emails, as many as necessary, with specific recommendations on when to get in, when to get out, and when to do nothing. Trading Flash Alerts anytime there is a hot opportunity or it’s time to sell. I will get follow-up emails, as many as necessary, with specific recommendations on when to get in, when to get out, and when to do nothing.

![•]() Up-to-the-Minute Trend Coverage of the most critical demographic and social trends affecting world markets,including the economic effects of the baby boomer retirement… the ongoing housing crash… the flight of capital from high-tax regions to those favoring economic development. Up-to-the-Minute Trend Coverage of the most critical demographic and social trends affecting world markets,including the economic effects of the baby boomer retirement… the ongoing housing crash… the flight of capital from high-tax regions to those favoring economic development.

![•]() Regular Online Video Reports with analysis and commentary on the important economic developments. Regular Online Video Reports with analysis and commentary on the important economic developments.

![•]() Monthly Issues of the Sizemore Investment Newsletter with detailed summaries of the major macro trend analysis affecting the world economy, including your detailed advice on the stocks to profit from these trends and portfolio positioning advice for the years ahead. Monthly Issues of the Sizemore Investment Newsletter with detailed summaries of the major macro trend analysis affecting the world economy, including your detailed advice on the stocks to profit from these trends and portfolio positioning advice for the years ahead.

![•]() Mid-Month Updates with a recap of the recent weeks’ action and a look at what will move the market in the weeks ahead. Mid-Month Updates with a recap of the recent weeks’ action and a look at what will move the market in the weeks ahead.

![•]() Encrypted Members-Only Website available 24 hours a day with a complete archive of past monthly newsletters, mid-month updates, special reports and videos. Encrypted Members-Only Website available 24 hours a day with a complete archive of past monthly newsletters, mid-month updates, special reports and videos.

Special Bonus Reports for Members Only: you’ll get the following special bonus reports the moment you subscribe:

- 4 Drip-and-Forget Dividend Picks

- Top 3 ETFs for Dividend-Hungry Investors

- 3 Safe “Emerging Markets Lite” Stocks to Buy Now

Now, I typically offer one trade recommendation a month—sometimes less, sometimes more—via email.

My recommendations are picked from the entire macro trend universe, wherever there's a potential fortune to be made.

And unlike many trend investing services, I will tell you precisely when you should take profits to lock in the gains in all of my recommendations.

As a result, I will send you follow-up emails, as many as necessary, with specific recommendations on when to get in, when to get out, and when to do nothing.

I will tell you right away when I think you should sell.

You also get ongoing and fast answers to your questions.

With my macro trend investing service, you can call or email our member services team at any time. You can even pose your questions directly to me.

As I mentioned, I can't provide personalized investment advice, of course.

But I can send the answers to your general questions to our small group of Charter Members. That means you'll also benefit from the questions of others.

Limited to Just 1,000

Charter Subscribers

Now, here’s the bad news: My brand-new The Sizemore Investment Letter is going to be limited to only 1,000 Charter Subscribers, at least at first.

I just don’t think I can give sufficient help to more than that.

However, anyone reading this message today can lock in one of those slots right now.

I'll show you how to do that in a minute.

Now, let's cut to the chase….

How much does a membership in my new macro trend advisory service cost?

I know many people assume it would be in the $1,000to $2,000 range because I'm not getting the fees I do in my money management program.

But that doesn't make sense to me.

The truth is, I want a core group of dedicated investors who are serious about making money.

How You Can Save $150 Off

Just by Acting Today!

The regular price for subscribers going forward willbe $199… but I’ve arranged for a special price for anyone willing to become a Charter Member today, as you'll see.

When you join today as a Charter Member, usingthe button below, you'll get the best possible deal.

You’ll get 75% OFF our regular subscription rate of $199—and pay just $49 for a full a year of my top macro trend picks.

That’s a spectacular value really, given the type of service this is… and considering you could easily recoup the cost within literally days of joining.

But as I said, this charter membership offer won't last long.

Considering that over 200,000 investors are being invited to consider this opportunity, I expect those 1,000 spots to sellout fast.

In fact, there's a chance all 1,000 charter membership slots will be taken by the end of next week.

And then then price will instantly move back up to$199 a year…

However, I do want to make it accessible to as many people as I can reasonably handle.

So here's what I agreed to do…

I decided to create a unique guarantee that, to me,is a no-brainer.

Test Drive The Sizemore Investment Letter

100% Risk-Free for the Next 90 Days

Simply Click Here to reserve one of the 1,000 Charter Memberships today,just to make sure you get in… and you'll be able to test drive The Sizemore Investment Letter for 90 days.

You can get in on the opportunities with real money or just “paper trade” them, to see how they do.

If you decide it's not for you, just give us a call within 90 days, and I'll refund your entire subscription fee—100% of it—no questions asked.

We'll give you your money back even if you don't follow ANY of my investment recommendations.

With a 90-day money-back guarantee, you have nothing to lose by locking in one of the 1,000 Charter Memberships right now.

This is a rare chance to get in on my very best macro trend picks—the same type of picks that let me nearly double my money on a single investment last year and come in second place in the 2012 Best Stocks stock picking competition and in first place in 2011.

Right now, only a handful of people have seen my current recommendations for 2013.

And their special access has already paid off in spades.

And as I record these words, I currently have 22 open positions and all but one are winners.

In fact, some of the macro trend investments I’ve recommended recently to early charter subscribers are already surging fast.

One is already up 81.7% since I recommended it.

Another is up 61.8%.

And yet another is up 62.3%.

Now is your chance to join us… to become an investing whale and not a minnow.

I hope you take advantage of our zero-risk test drive for 90 days.

You have nothing to lose… and a lot of profits to gain.

Just click on the big button below right now,fill in the form and press submit.

If you’re not immediately delighted by the profits you see from investing in Global Macro Trends over the next several months,simply let us know within 90 days and you’ll get 100% of your subscriptionprice back, no questions asked.

Best wishes, Best wishes,

Charles Sizemore

Editor, The Sizemore Investment Letter

P.S. Secure your Charter Membership today and start making big profits in a hurry by investing in Global Macro Trends. Remember, if you’re notdelighted with the results you see over the next several months, simply letus know within 90 days and you’ll get 100% of your subscription price back,no questions asked. |